Loans greater than $15,000 or less than $1,500 are funded through our branch network. Loans between $1,500 and $15,000 may be funded online. †We offer personal loans from $1,000 to $25,000, with minimum and maximum amounts dependent on an applicant’s state of residence and the underwriting of the loan. Your repayment amount must be in the form of cash or certified funds.Ĭalifornia Residents: Loans made or arranged pursuant to a California Financing Law license.

Mariner finance loan status full#

**15 Day Satisfaction Guarantee: If, for any reason, you are dissatisfied with your loan and repay it in full within 15 days we will waive all finance charges with no penalties. This “hard” credit inquiry may impact your credit score. If you continue with the application process online and accept a loan offer, or are referred to a branch and continue your application there, we will pull your credit report and credit score again using a “hard” credit inquiry. *The process uses a “soft” credit inquiry to determine whether a loan offer is available, which does not impact your credit score.

Mariner finance loan status license#

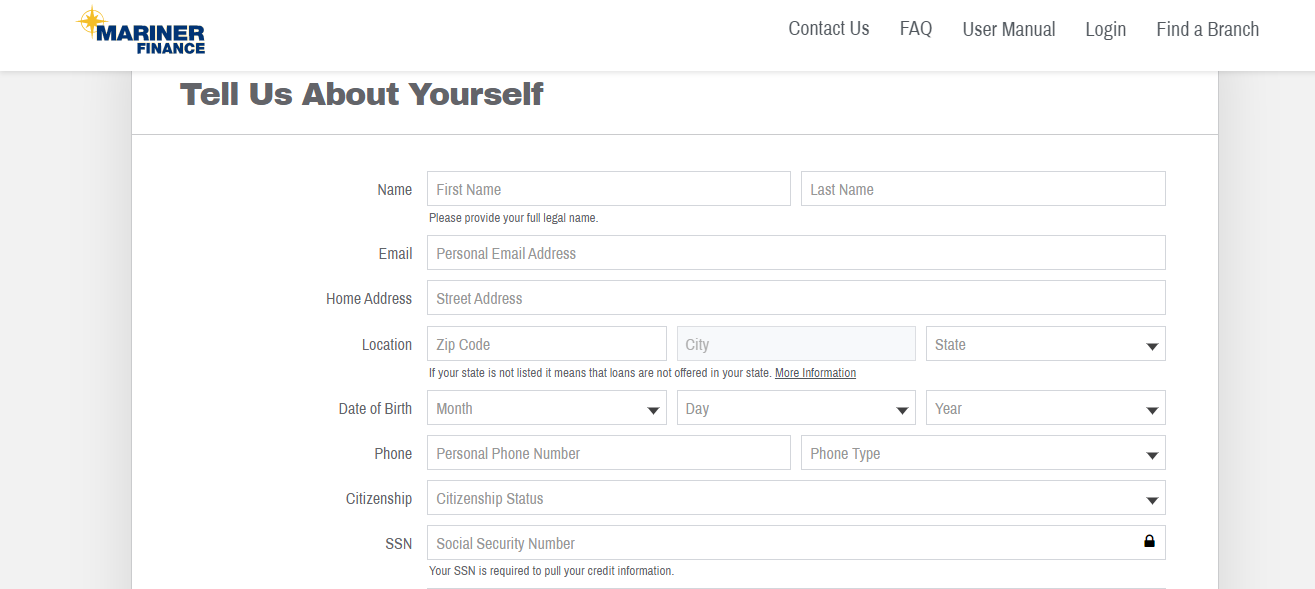

We may also ask to see your driver’s license or other identifying documents. As a result, under our customer identification program, we must ask for your name, street address, mailing address, date of birth, and other information that will allow us to identify you. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Not all applicants will qualify for the lowest rates or larger loan amounts, which may require a first lien on a motor vehicle not more than ten years old titled in the applicant’s name with valid insurance. Not all rates and loan amounts are available in all states. Specific interest rates and fees are determined as permitted under applicable state law and depend upon loan amount, term, and the applicant’s ability to meet our credit criteria, including, but not limited to, credit history, income, debt payment obligations, and other factors such as availability of collateral. Meanwhile, if a borrower received a federal Pell grant during his college years, will be eligible to a $20,000 debt forgiveness.We offer personal loans from $1,000 to $25,000, with minimum and maximum amounts dependent on an applicant’s state of residence and the underwriting of the loan.

Married couples with less than $250,000 income in those years can also apply. How does the student loan forgiveness program work?įor the eligibility of this program, the income will be evaluated.īorrowers who made less than $125,000 individually during 2020 or 2021 -the years the pandemic affected the most- can apply for a $10,000 federal student loan forgiveness. The vote regarding the legislation ended up being 52-46, but for Biden, the intention behind the student loan forgiveness program deserves a veto. Student loans payments will resume on the next half of 2023 and there's concern that, for post-pandemic economic struggles, a lot of Americans might have trouble to achieve the payment.

On the other hand, the White House and US President Joe Biden had expressed that, from their point of view, this measure's goal is only to provide help for those borrowers to avoid defaulting.

0 kommentar(er)

0 kommentar(er)